As the world continues to evolve, so do our expenses—especially when it comes to fuel; Understanding your average monthly gas expenses is crucial for budgeting and financial planning. In this article, we’ll delve into the factors affecting gas prices, average costs across regions, and tips for managing and reducing these expenses.

Understanding Gas Prices

Gas prices fluctuate due to various factors, including:

- Global Oil Prices: Gas prices are heavily influenced by the price of crude oil, which is subject to international markets and geopolitical events.

- Supply and Demand: Seasonal demand, such as increased travel during summer months or holidays, can drive prices up.

- Local Taxes and Regulations: Different states and municipalities impose varying levels of taxes on gasoline, impacting overall costs.

- Refinery Capacity: Maintenance issues or natural disasters affecting refineries can limit supply and cause price spikes.

Average Monthly Gas Expenses by Region

The average monthly gas expenses can vary significantly depending on where you live. According to recent data, here’s a breakdown of average costs across different regions in the United States:

- West Coast: The West Coast typically sees the highest gas prices, averaging around $4.00 per gallon. This translates to approximately $150-$200 per month for a typical driver.

- Midwest: The Midwest enjoys some of the lowest prices, averaging about $3.00 per gallon, leading to monthly expenses around $100-$150.

- South: Southern states have moderate prices, averaging $3.20 per gallon, resulting in expenses of about $120-$170 per month.

- Northeast: In the Northeast, prices hover around $3.50 per gallon, averaging monthly expenses of $130-$180;

Factors Influencing Your Personal Gas Expenses

While regional averages provide a broad overview, your personal gas expenses may differ based on:

- Vehicle Efficiency: The make and model of your car significantly affect how much fuel you consume. Fuel-efficient cars can save you money.

- Driving Habits: Frequent short trips, aggressive driving, and idling can increase your gas consumption.

- Commute Distance: The longer your commute, the more gas you’ll use. Consider carpooling or public transport to reduce expenses.

- Gas Prices in Your Area: Local competition among gas stations can lead to price variations, so be sure to shop around.

Tips to Manage and Reduce Gas Expenses

With rising fuel costs, managing your gas expenses has never been more important. Here are some actionable tips to save money:

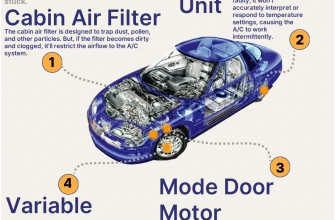

- Maintain Your Vehicle: Regular maintenance, such as oil changes and tire inflation, can improve fuel efficiency.

- Plan Your Trips: Combine errands and plan routes to minimize driving distances.

- Use Apps: Fuel price comparison apps can help you find the cheapest gas near you.

- Consider Alternative Transportation: If feasible, switch to biking, walking, or public transportation when possible.

- Reduce Weight: Remove unnecessary items from your vehicle to improve fuel efficiency.

Understanding and managing your average monthly gas expenses is vital in today’s economic climate. By being aware of the factors that influence gas prices and implementing strategies to reduce consumption, you can keep your fuel costs in check. Remember, every small change can lead to significant savings over time.

Stay informed, budget wisely, and drive smart!

Analyzing Your Gas Consumption Patterns

To effectively manage your gas expenses, it’s essential to analyze your consumption patterns. Start by keeping a meticulous record of your fuel purchases over several months. This will help you identify trends, such as seasonal increases in usage or spikes during specific times of the month, enabling you to better anticipate and budget for future expenses.

Consider using mobile apps designed for tracking fuel consumption. Many of these applications allow you to log your gas purchases and provide insights into your driving habits. By comparing your consumption with the average for your vehicle type, you can spot inefficiencies and adjust your driving style accordingly.

The Role of Fuel Rewards Programs

Many gas stations offer fuel rewards programs that can significantly cut down your expenses. These rewards can come in various forms, including discounts per gallon, cashback on credit card purchases, or points that can be redeemed for future fuel purchases. If you frequently buy gas from a specific chain, enrolling in their rewards program can lead to substantial savings over time.

Additionally, consider using credit cards that offer bonuses for gas purchases. Many financial institutions have tailored rewards cards that allow you to earn points or cashback specifically on fuel purchases, which can further enhance your savings.

Alternative Transportation Options

As gas prices continue to fluctuate, exploring alternative transportation options can be a game-changer. Carpooling is an excellent way to share the cost of gas, while public transportation can reduce your fuel expenses significantly. In urban areas, biking or walking for short distances not only saves money but also promotes a healthier lifestyle.

For longer commutes, consider hybrid or electric vehicles, which are becoming increasingly popular due to their fuel efficiency and lower emissions. Although the initial investment may be higher, the long-term savings on gas can be substantial, making it a financially sound choice for many drivers.

Looking Ahead: The Future of Gas Expenses

As our society becomes more aware of climate change and sustainable practices, the future of gas expenses may shift. The rise of electric vehicles, improvements in public transportation, and advancements in alternative fuels could lead to a decrease in gasoline demand. This shift may not only impact your average monthly gas expenses but also reshape the entire automotive landscape.

Staying informed about trends in fuel prices, vehicle technology, and alternative transportation methods will help you make informed decisions regarding your gas expenses. Monitoring market changes can also provide insight into when to purchase fuel at lower prices, enhancing your overall budgeting strategy.

Gas expenses are an ongoing consideration for drivers, but with proactive management and strategic thinking, you can minimize your costs. By understanding the factors that influence gas prices, adopting efficient driving habits, leveraging rewards programs, and exploring alternative transportation options, you can take control of your monthly fuel expenses. As the landscape of transportation changes, staying adaptable and informed will ensure you remain financially savvy in the face of fluctuating fuel costs.

Ultimately, your average monthly gas expenses do not have to be a burden. With careful planning and a willingness to explore new options, you can drive towards a more cost-effective future.

The tips for managing gas expenses are invaluable. I never realized how much my vehicle’s efficiency could impact my monthly budget!

This article is a must-read for anyone looking to get a handle on their fuel costs. The information is clear and well-organized. Thank you!

Excellent article! The regional comparisons of gas prices were eye-opening. Now I know why I pay so much more living on the West Coast.

This article provides a comprehensive overview of gas prices and their fluctuations. I found the breakdown by region particularly helpful for budgeting my monthly expenses!

I appreciated the insights on factors affecting gas prices. Understanding these can really help us plan our finances better. Great read!

I learned so much from this piece, especially about how local taxes affect gas prices in different areas. Very informative and useful!